The Indian real estate market in 2025 is both a land of opportunity and complexity. With the sector projected to contribute 13% to India’s GDP this year—up from 7% in 2024—and an expected market size nearing USD 1 trillion by 2030 (Source: IBEF), navigating this dynamic environment demands more than intuition.

In such a crowded, high-stakes market, professional Real Estate Consulting is no longer a luxury—it’s a strategic necessity for developers, investors, and institutional stakeholders. Clarity, grounded in data and expert insight, has become the necessary competitive advantage.

The Information Overload Challenge

Today’s real estate ecosystem is characterized by data abundance but insight scarcity. With information coming from brokers, portals, regulatory filings, and public data sources, separating signals from noise has become the hardest part of decision-making.

Adding to this challenge, data availability across geographies is uneven. While metros and Tier 1 cities have relatively structured data ecosystems, Tier 2 and Tier 3 markets often lack readily available, high-quality data. Where data does exist, it’s frequently fragmented, inconsistent, or filled with noise, making it difficult to extract meaningful insights.

Moreover, with the growing integration of AI-driven data generation and analysis, another layer of complexity has emerged — not all AI-created or aggregated data is reliable or trustworthy. Automated scraping, model hallucinations, and unverified inputs can lead to misleading conclusions if not validated through expert review and ground intelligence. Some challenges that make the onboarding of a Real Estate(RE) consultant necessary:

1. Variation Within the Same Micro-Market

Even within the same locality, pricing, absorption rates, and demand drivers can shift even within a radius of 1km. Micro-market variations depend on site conditions, the surrounding neighbourhood, connectivity, upcoming infrastructure, and competing supply. RE Consultants decode these nuances to prevent overpaying or developing in oversaturated pockets.

2. Regulatory and Compliance Complexity

For any real estate project, obtaining the necessary approvals, permissions, and fulfilling compliance obligations constitutes a significant part of a developer’s responsibilities—and often a major cost component, especially post-RERA. Consultants play a vital role by helping interpret these regulations, streamline documentation, and align business models with state and central policies—transforming compliance from a challenge into a strategic advantage.

3. Shifting Consumer and Asset Preferences

India’s demographic shift—led by millennial and Gen Z homebuyers—has redefined product preferences. Integrated living, flexible workspaces, green buildings, and co-living, co-working models are emerging asset classes. RE Consultants help developers with catchment analysis, buyer profiling, and product-market fit(product mix formulation), ensuring the right design and pricing strategy.

Without professional guidance, investors risk betting on perception rather than market reality—leading to unviable projects, inflated costs, and delayed completions.

Real Estate Consulting as a Strategic Compass

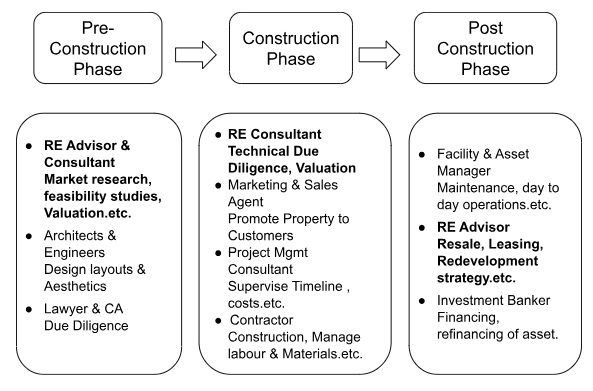

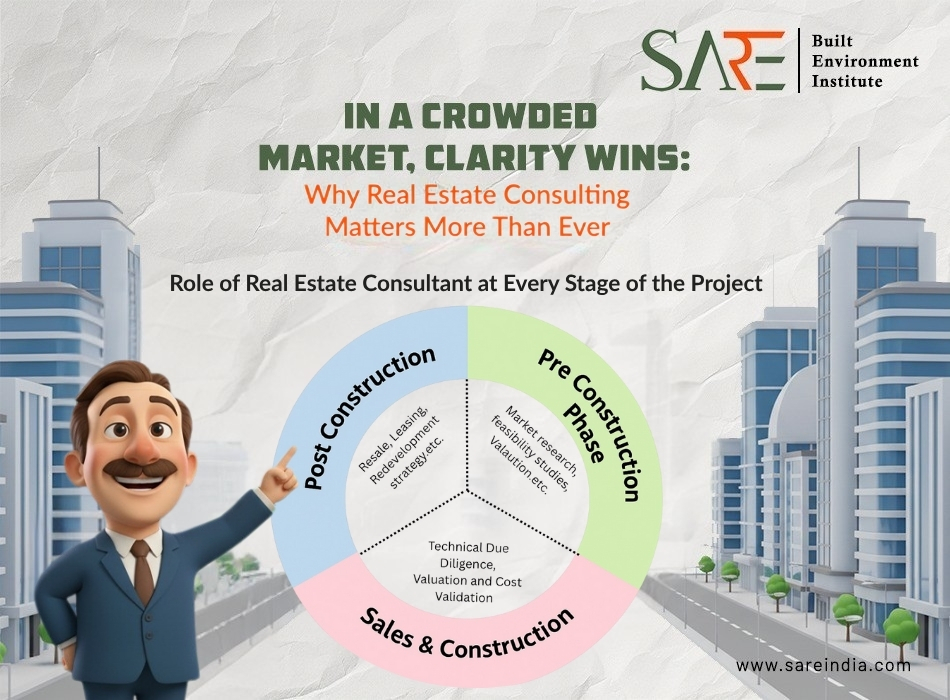

Real Estate(RE) Consulting plays a decisive role across every stage of the real estate lifecycle—from redevelopment to operation—ensuring that each phase is rooted in clarity and returns optimization.

Consulting Services at each stage of the project:

Role of RE Consultant in different stages of the real estate project life cycle:

1. Ideation & Feasibility: Data Before Design

Key Consulting Inputs:

- Market Absorption & Competitive Supply: Identify demand-supply gaps, optimal pricing, and growth potential for redevelopment or greenfield projects.

- Land Title & Zoning Validation: Evaluate ownership structures, regulatory approvals, and site accessibility.

- ROI Modeling & Capital Structuring: Build financial models balancing developer margins, investor returns, and project timelines.

Outcome: A data-backed feasibility roadmap that minimizes acquisition risk and ensures every rupee invested works toward sustainable returns

Once feasibility and land are established, RE consultants translate vision into executable design, ensuring compliance and profitability.

Key Consulting Inputs:

- Catchment Profiling & Income Mapping: Define target demographics, their affordability range, and evolving lifestyle needs.

- FSI, Zoning & Environmental Compliance: Align concepts with development control regulations to prevent future disputes.

- Phased Development & Cash Flow Optimization: Strategize project rollout in stages to maintain liquidity and reduce risk.

- Product Mix & Pricing Matrix: Fine-tune configurations and amenities to achieve optimal market fit.

Outcome: A compliant, consumer-aligned, and financially sound project blueprint ready for launch.

During construction, RE consultants act as strategic overseers—ensuring accountability, transparency, and financial prudence.

Key Consulting Inputs:

- Technical Due Diligence: Assess site feasibility, design approvals, and construction quality; verify land titles, RERA registration, and environmental clearances to ensure full project compliance and risk mitigation.

- Valuation & Cost Validation: Benchmark costs against market trends to prevent overspending.

- Risk & Fund Flow Monitoring: Track fund deployment, vendor performance, and progress milestones to ensure timely delivery and prevent budget overshoots.

Outcome: Seamless execution with minimized overruns and stronger investor confidence.

Post-construction, consulting focus shifts from creation to optimization—maximizing asset yield and lifecycle value.

Key Consulting Inputs:

- Facility & Asset Management Advisory: Streamline operations, maintenance budgets, and sustainability compliance.

- M&A and Divestment Advisory: Structure transactions and evaluate valuations for mergers, acquisitions, or asset sales.

- Portfolio Optimization & Repurposing: Identify underperforming assets, repurpose spaces, and improve ROI through data-backed insights.

Outcome: Long-term profitability and asset resilience through proactive management and strategic reinvestment.

Beyond Metros: The Tier 2 & Tier 3 Opportunity

While metros like NCR, Mumbai, and Bengaluru dominate consulting activity, India’s next wave of real estate growth is unfolding in Tier 2 and Tier 3 cities—Lucknow, Jaipur, Surat, Coimbatore, and beyond.

Driven by expanding infrastructure, new employment corridors, and growing urban aspirations, these regions are ripe for scalable development.

However, data fragmentation, limited transparency, and inconsistent pricing benchmarks make them challenging terrain without expert guidance.

Real Estate Consultants bridge this gap by:

- Validating Land Value & Market Potential: Conducting ground surveys, analyzing transaction data, and aligning pricing with realistic demand projections.

- Negotiating Land & Joint Venture Deals: Structuring win-win partnerships between landowners, developers, and investors with equitable revenue-sharing models.

- Planning Scalable, Sustainable Projects: Designing projects aligned with local infrastructure plans and long-term demographic shifts.

- Forecasting Long-Term Demand & Pricing Trends: Using comparative analytics from similar growth corridors to anticipate future appreciation and absorption rates.

The Road Ahead: Embracing Expertise

India’s real estate growth story remains robust—driven by urbanization, infrastructure expansion, and investor confidence. The residential market alone is valued at USD 399.11 billion in 2025 (Source: Mordor Intelligence).

However, developers and investors continue to face persistent challenges:

- Rapid Urbanization: Creates both opportunity and resource strain, requiring a precise location strategy.

- Data Scarcity: Reliable on-ground data remains fragmented, especially in emerging Tier 2/3 markets.

- Dynamic Policy Landscape: Constant changes in taxation, land laws, and environmental regulations increase uncertainty.

In the face of these variables, relying on qualified and experienced real estate consultants, who blend technical proficiency with deep local market intelligence, is the clearest path to successful outcomes. Their expertise turns complex data into simple clarity, ensuring every decision you make is informed, compliant, and strategically sound.

Partnering for Clarity: SARE India

Ready to move from guesswork to a data-backed, clear investment strategy? Partner with SARE India to transform uncertainty into a strategic advantage. Our mission is to guide you through the complexities of real estate with comprehensive Feasibility Studies that analyze market viability and risk, tailored Advisory solutions that navigate regulatory mazes, and expert Management Services for precise project execution. With a commitment to sustainable growth, innovation, and maximizing returns, SARE India empowers developers, investors, and corporate stakeholders to identify high-potential opportunities, mitigate risks, and build future-ready real estate assets that deliver enduring value in India’s dynamic market.

0 Comments