India’s real estate and built environment sector has become one of the country’s strongest economic pillars — contributing 7.3% (USD 305B) to India’s GDP today, with projections estimating growth to USD 4.26T by 2047 (Source of Information: Real Estate Industry Report, Aug, 2025 | The Hindu, Jan, 2025)

The industry already employs 70M+ professionals, and is expected to generate 100M+ jobs by 2030 (Source of Information: Skilled Employment in Construction Sector in India, Knight Frank & RICS, 2023 | The Economic Times, Aug 2023 )

However, India will require an additional 23M skilled real estate professionals by 2030 — nearly 8× the current qualified talent pool, of which only 4% hold formal industry-aligned training.

This imbalance highlights a simple truth: The sector needs professionals who are not just educated, but truly industry-ready.

This is exactly the gap SARE Built Environment Institute (SBEI) aims to bridge.

At SBEI, learning is designed to be practical, relevant, and immediately useful. The focus is simple — break down complex real estate concepts into clear, actionable skills you can confidently apply from day one of your role.

SBEI has collaborated with real estate industry leaders and academic experts to create programs that will build job-ready real estate professionals. Equipping them with core fundamentals and advanced industry knowledge.

Our programmes are built in collaboration with industry leaders and academic experts, ensuring learners gain both local market insight and global perspective. The curriculum spans the entire real estate value chain—from development fundamentals, valuation, sales and leasing, and asset management to regulatory compliance and modern investment structures such as REITs, InvITs, and fractional ownership models.

Our Advisory Board includes senior mentors from the Indian real estate industry and academia, along with distinguished U.S. real estate faculty, ensuring learners receive insights that are locally relevant and globally informed.

The key differentiator that makes us industry-led, applied, and outcome-driven:

- Practitioner-led case studies and live industry problem statements

- Actionable frameworks across compliance, transactions, valuation, investments, asset structuring, ESG, and PropTech

- Curated networking events, industry forums, and community engagement

- Mentorship access from top industry and academic advisors

- A stackable “Learn While You Work” pathway—ranging from individual module certifications and advanced certificates to post-graduate certificates, executive PGDMs, and full-time PGDM programmes.

- Designed for aspiring entrants to real estate, early-career professionals, and experienced practitioners looking to upskill or transition into the sector.

This is not just upskilling — it is capability building powered by real mentors, real case studies, and real industry networks.

informed.

New Year. Smarter Resolutions. Stronger Outcomes.

To support professionals committed to meaningful career growth in 2026, SBEI is extending New Year offers on select courses, featuring limited-period discounts.

Because the right resolution deserves the right launchpad.

.

Recent Blogs

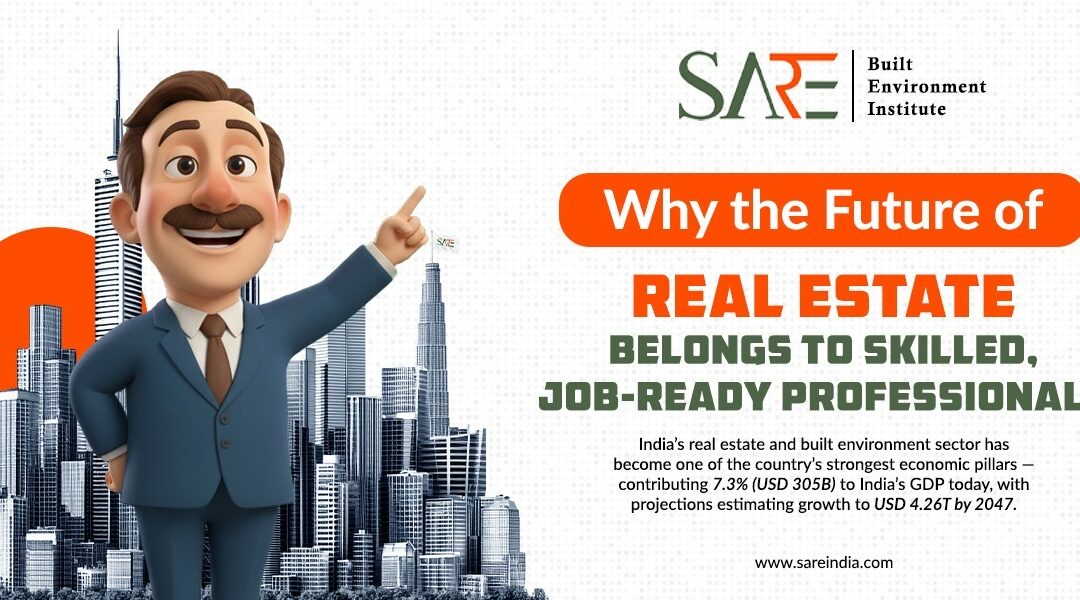

In a Crowded Market, Clarity Wins: Why Real Estate Consulting Matters More Than Ever

The Indian real estate market in 2025 is both a land of opportunity and complexity. With the sector projected to contribute 13% to India’s GDP this year—up from 7% in 2024—and an expected market size nearing USD 1 trillion by 2030 (Source: IBEF), navigating this...

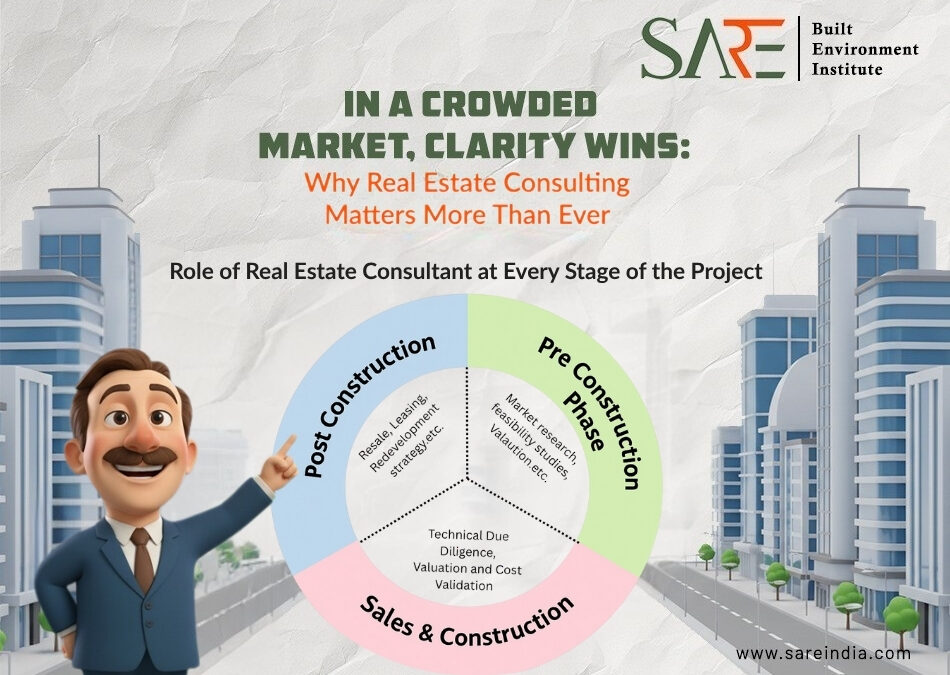

Emerging Asset Classes Reshaping Indian Real Estate in 2025

India’s real estate sector is undergoing a dynamic transformation, moving beyond conventional residential housing and office spaces into Residential, Commercial, Retail, and Hospitality asset classes. This major shift is driven by changing lifestyles, urbanization,...

GST Reform and Its Effect on Indian Real Estate

India’s real estate sector has long been seen as both a driver of economic growth and a reflection of consumer sentiment. With Real Estate contributing nearly 7–8% to the national GDP and employing over 50 million people, even small policy shifts can have cascading...

0 Comments